nd sales tax permit

For purchases made by a North Dakota exempt entity the purchasers tax. Direct shippers are required to have a North Dakota sales and use tax permit.

Sales Tax Guide For Online Courses

Tax permit number issued to you or your business by the North Dakota Office of State Tax Commissioner.

. Ad Simplify the sales tax registration process with help from Avalara. A sales tax permit can be obtained by registering online with the North Dakota Taxpayer Access Point TAP or by mailing in the Sales and Use Tax Permit Application Form. This means that if you are considering opening a new business or are beginning to make sales in North Dakota for the.

In North Dakota most businesses are required to have a sales tax permit. Tax ID Bureau eServices stays current with the changing laws forms and documents in order to ensure a smooth quick and efficient sales tax registration for your business. This free and secure.

A North Dakota Sales Tax Permit can only be obtained through an authorized government agency. Depending on the type of business where youre doing business and other specific. A North Dakota sales tax permit is not the same as a North Dakota resale certificate.

Licensed direct shippers are required to file reports annually with the Office of State Tax Commissioner. North Dakota Sales Tax Application Registration. Where to Register for a North Dakota Sales Tax Permit.

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. The former allows a company to make sales inside a state and collectremit sales tax for those sales.

View more information about the combined state and city rates within the. Fill out one form choose your states let Avalara take care of sales tax registration. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

The exemption for each new mine is limited. There are two ways to register for a sales tax permit in North Dakota either by paper application or via the online. Registered users will be able to file and.

Ad Fast Online New Business Sale Tax Permit. In the state of North. This is a sales and use tax exemption and refund for machinery or equipment used to produce coal from a new mine in North Dakota.

The sales tax rate for Bismarck North Dakota when combined with State and County taxes is 7 percent. If you purchase an existing business you must apply for a new sales tax permit as permits are not transferable. Fast Processing for New Resale Certificate Applications.

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit. Ad Fast Online New Business Sale Tax Permit.

The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov. You should apply for a permit 30 days prior to opening for business. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. Tribal and Local Tax Changes Effective July 1 2016.

A sellers permit is commonly. Wednesday December 29 2021 - 0100 pm. Fast Processing for New Resale Certificate Applications.

North Dakota Sales Use and Gross Receipts Tax Permit Holders. Any business that sells goods or taxable services within the state of North Dakota to customers located in North Dakota is required to.

North Dakota Sales Tax Small Business Guide Truic

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

How Do State And Local Sales Taxes Work Tax Policy Center

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

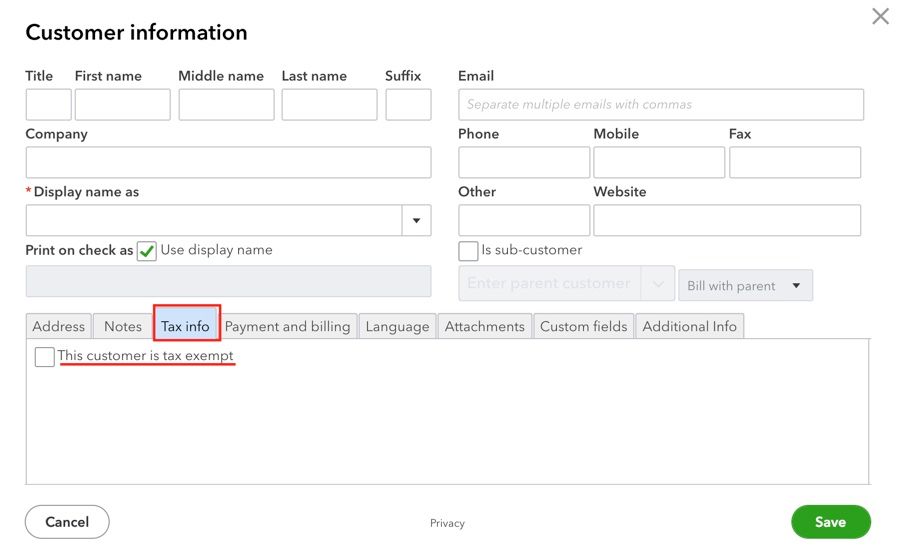

Setting Up Sales Tax In Quickbooks Online

Sales Tax For Small Businesses Truic

How To Start An Online Boutique With Shopify In 8 Easy Steps A Step By Step Guide Starting An Online Boutique Online Boutique Boutique

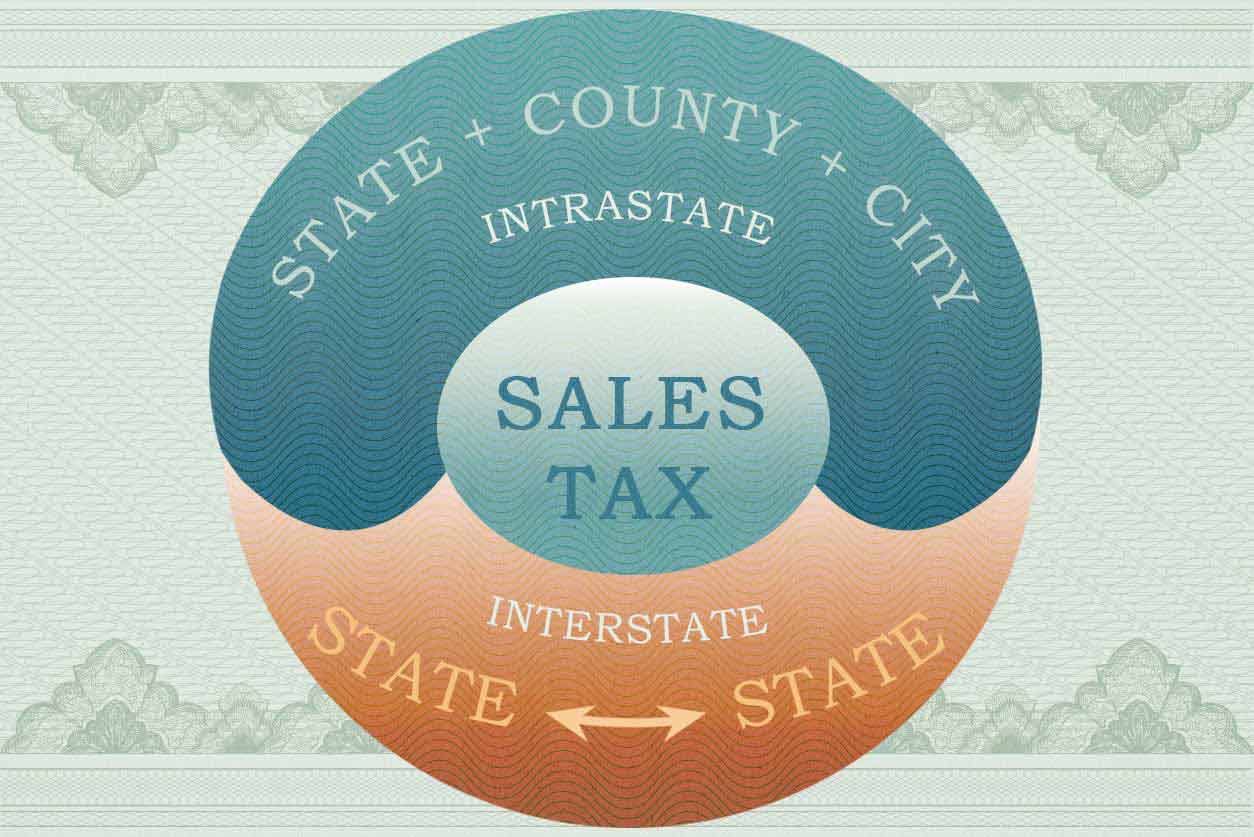

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

Visa Requirements Hong Kong Vs Chinese Passport Maps On The Web Hong Kong Visa Brazil Vs Argentina Cartography

How To Register For A Sales Tax Permit In North Dakota Taxjar

Authorization Letter To Claim Writing An Authorization Letter For Claiming Documents Is To Be Very Specific And Deta Lettering Letter Writing Samples Writing

How To Register For A Sales Tax Permit In North Dakota Taxjar

Setting Up Sales Tax In Quickbooks Online

About The North Dakota Office Of State Tax Commissioner

Sales Tax The Complete Guide To Sales Tax In The United States Taxjar

Used Vehicle California Sales Tax And California Board Of Equalization

Home Depot Invoice Template 17 Home Depot Receipt Template Application Letter In 17 Receipt Template Application Letters Templates

How To Get A North Dakota Sales Amp Use Tax Permit North Dakota Sales Tax Handbook